Annual Limits on Qualified Plans for 2025

On November 1, 2024, the Internal Revenue Service (IRS) released Notice 2024-80, which sets forth the 2025 cost-of-living adjustments affecting dollar limits on benefits and contributions for qualified retirement plans. The IRS also announced the health savings account (HSA) and high deductible health plan (HDHP) annual deductible and out-of-pocket expense adjustments earlier this year in Revenue Procedure 2024-25 and the health flexible spending arrangement (Medical FSA) adjustments in Revenue Procedure 2024-40. Finally, the Social Security Administration announced its cost-of-living adjustments for 2025 on October 10, 2024, which includes a change to the taxable wage base.

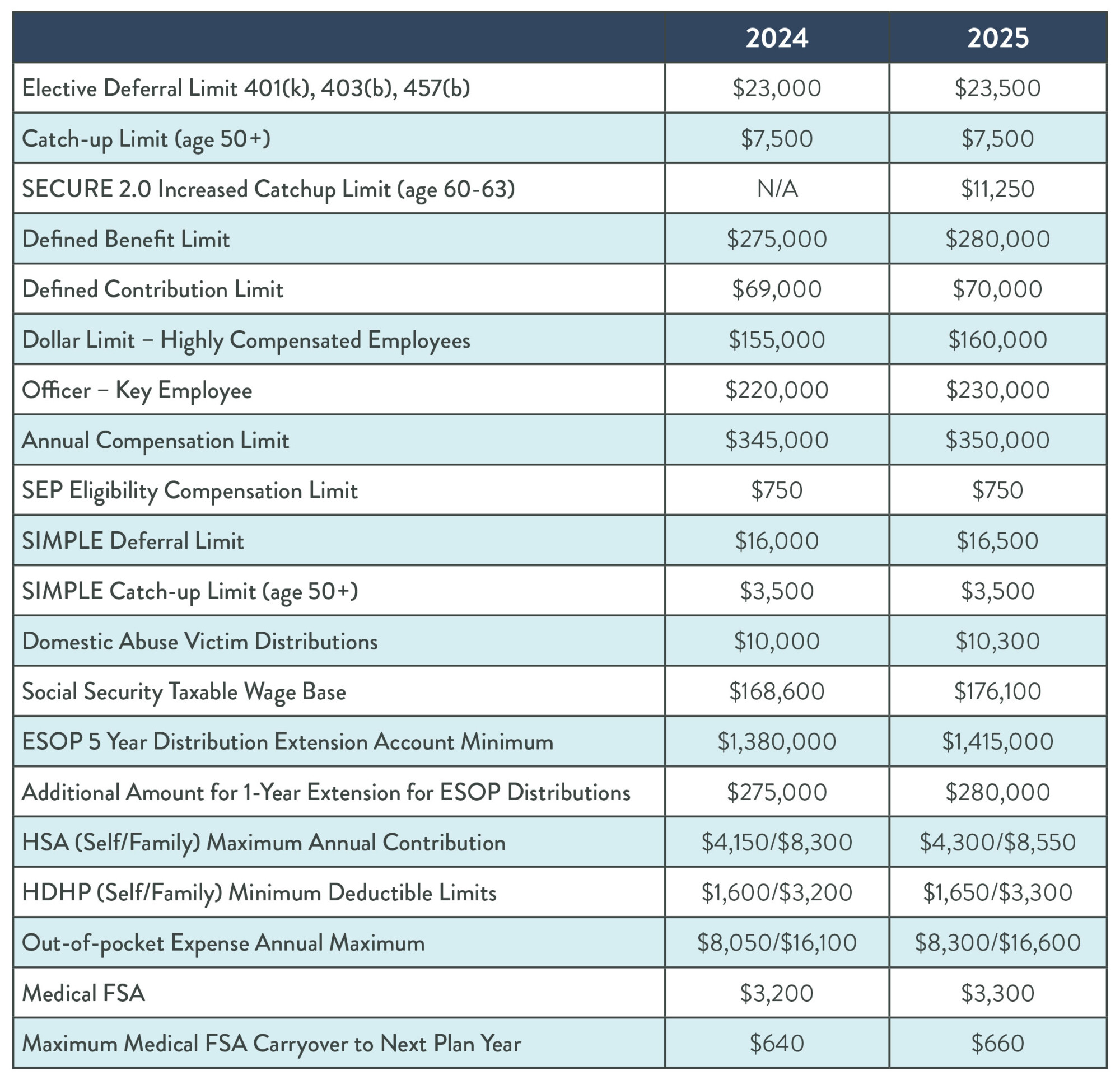

The following chart summarizes the 2025 limits for benefit plans. The 2024 limits are provided for reference.

For more information on the 2025 cost-of-living adjustments, please contact Audrey Fenske, Nick Bertron, Stephanie Schmid or one of the attorneys listed below or the Stinson LLP contact with whom you regularly work.