HSR Act Updates - Updated Thresholds and a Legal Challenge to the HSR Amendments

On January 10, 2025, the Federal Trade Commission (FTC) announced the Revised Jurisdictional Thresholds for Section 7A of the Clayton Act to the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (HSR Act). The U.S. Chamber of Commerce, Business Roundtable, American Investment Council, and Longview Chamber of Commerce filed a complaint against defendants FTC and FTC Chair Lina Khan, alleging that the final rule violates the Administrative Procedure Act (APA).

HSR ACT THRESHOLD UPDATE

The FTC must revise the HSR Act thresholds annually based on the change in the gross national product. The size-of-transaction filing threshold will increase from the 2024 threshold of $119.5 million to the 2025 threshold of $126.4 million. The changes will be effective for transactions closing on or after the effective date of the notice, which is 30 days after the date of the notice’s publication in the Federal Register.

Under the new thresholds and absent an applicable exemption, the parties to an acquisition or merger will need to file premerger notifications with the Department of Justice (DOJ) and the FTC and observe the HSR Act's waiting period if the transaction results in either of the following:

- Acquiring person will hold at least $126.4 million worth of voting securities and assets of the acquired person and the parties meet the "size-of-person" requirements (set forth below).

- Acquiring person will hold at least $505.8 million worth of voting securities and assets of the acquired person, regardless of the size of the parties.

Meeting any one of the following subtests satisfies the "size-of-person" test:

- When a person with $252.9 million or more of total assets (on its most recent regularly prepared balance sheet) or annual net sales (from its most recently completed fiscal year) proposes to acquire voting securities or assets of a person with $25.3 million or more of total assets or annual net sales.

- When a person with $25.3 million or more of total assets or annual net sales proposes to acquire voting securities or assets of a person with $252.9 million or more of total assets or annual net sales.

For the purpose of applying the thresholds, the term "person" means the ultimate parent entity of the party engaged in the transaction. Certain exemptions may apply, depending on the nature of the transaction and the location and nature of the assets and entities involved. As a result, additional analysis is often required before making a final determination regarding the need for a filing.

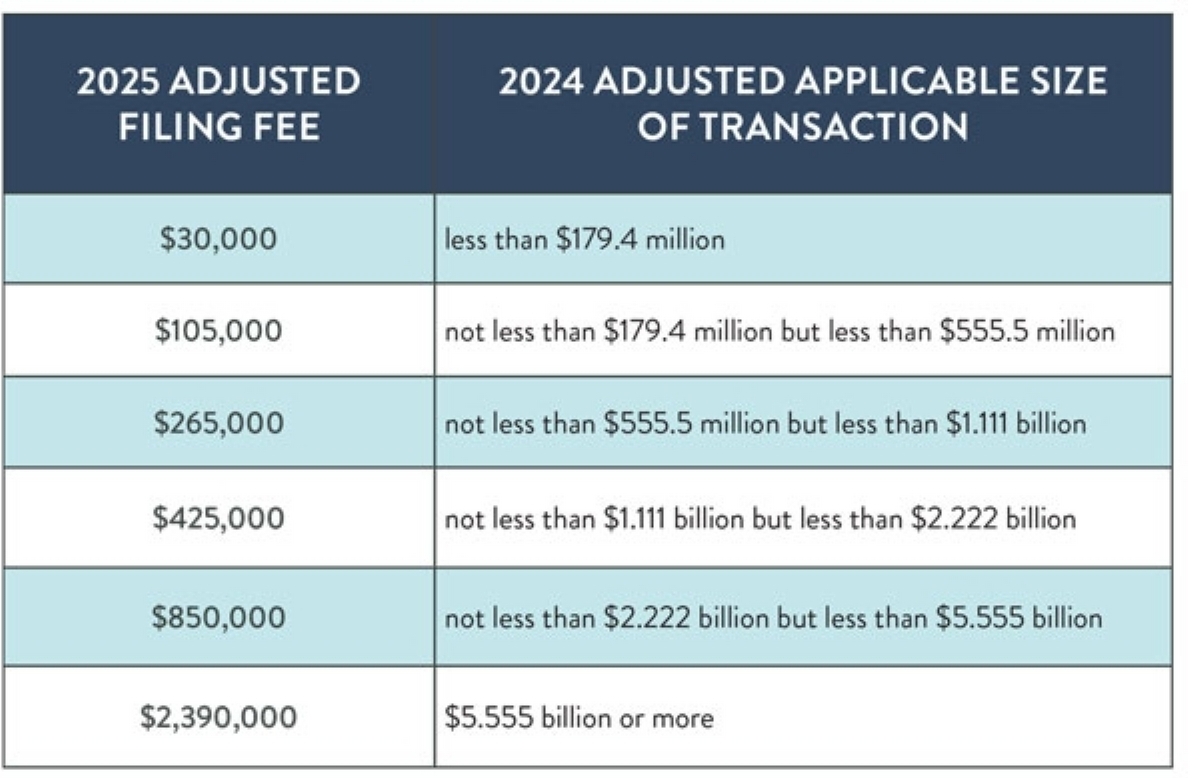

The FTC must also revise the filing fee thresholds annually based on the change in the gross national product. The following filing fee schedule will take effect on the date that is 30 days after the date of the notice’s publication in the Federal Register.

CHAMBER OF COMMERCE COALITION LAWSUIT

On October 10, 2024, the FTC announced long-awaited finalized changes to the premerger notification form and associated instructions, as well as the premerger notification rules implementing the HSR Act. The HSR Act and its implementing rules require the parties of certain mergers and acquisitions to submit premerger notification (HSR forms) to the federal government and to wait a specified period before consummating their transaction. The FTC and Antitrust Division of the DOJ use this information to conduct a premerger assessment during the “waiting period” of the HSR Act, typically 30 days.

On January 10, 2025, the U.S. Chamber of Commerce, Business Roundtable, American Investment Council, and Longview Chamber of Commerce filed a complaint against defendants FTC and FTC Chair Lina Khan, alleging that the final rule violates the APA Complaint-Chamber-of-Commerce-v.-FTC-E.D.-Tex. The complaint alleges, among other things, that the final rule exceeds the FTC's statutory authority and that the rule's overall benefits do not reasonably outweigh its costs. The plaintiffs request, among other things, a declaratory judgment that the final rule is in excess of statutory authority, arbitrary, capricious, or otherwise contrary to law either in whole or in part; an order setting aside the final rule in its entirety or insofar as the court finds it in excess of statutory authority, arbitrary, capricious, or otherwise contrary to law; and an order enjoining the FTC from enforcing the final rule or any requirement therein found to be in excess of statutory authority, arbitrary, capricious, or otherwise contrary to law.

The final rule is set to become effective on February 10, 2025, though this could be delayed by the recently filed litigation and also by the new administration taking office.

For more information on these updates, please contact Jeetander Dulani, Heather Franco, Bill Kearney, Nicci Warr or the Stinson LLP contact with whom you regularly work.