The Trump Administration Signals Significant Changes to CFPB's January 2025 Initiatives

Many have been left wondering whether there will be material changes by the Trump administration to the recently released proposed and final rules, policy statements and requests for public comments on various initiatives by the Consumer Financial Protection Bureau (CFPB), and all signs point to "yes." The administration has, and is exercising, multiple tools in its toolbox to do so.

Developments Since Trump Took Office

Presently, the administration's longer-term approach to CFPB's ongoing and recently finalized initiatives is in flux. Our alert briefly summarizes the landscape of these various pronouncements, followed by a short chart for tracking of developments. We are monitoring the developments daily, so please reach out to your Stinson team for the latest counsel.

First, on January 20, 2025, President Trump issued an order directing all executive departments and agencies to (1) not propose or issue any rule until a new appointee has reviewed and approved it, (2) immediately withdraw any rules not yet published in the Federal Register, and (3) consider postponing for 60 days any rules that have been published, to review any questions of fact, law and policy that may be raised by such rules, and consider further delay or opening new comment periods on such rules.1

Second, on February 3, Treasury Secretary Scott Bessent, in his capacity as Acting Director of the Consumer Financial Protection Bureau (CFPB), reportedly sent an email to staff ceasing work immediately on investigations or probes, litigation, rulemaking or enforcing rules, and public communications.2

Additionally, we are still within the period for Congress to pass a joint resolution of disapproval of “major” rules, which pursuant to the Congressional Review Act, must be done within a 60-day period (the later of the date of publication in the Federal Register or the receipt of the required report by Congress on the rule), rendering the rule ineffective and not in force.

Proposed Rule and Request for Comment on Consumer Electronic Fund Transfers Using Emerging Payment Mechanisms

The CFPB has proposed an interpretive rule to broaden the scope of consumer protections for electronic fund transfers (EFTs) to cover use of digital assets as a payment method. The CFPB would characterize providers of virtual currency wallets holding digital assets that may be used in that manner as "financial institutions" and the transfers of such assets in connection with such wallets as "electronic fund transfers."

Examples of electronic fund transfers potentially subject to scrutiny under this new interpretative rule include:

- Video game accounts.

- Virtual currency wallets.

- Credit card rewards points programs.

The comment period for this proposed rule is slated to end on March 31, 2025.

Proposed Rule and Request for Comment on Prohibited Terms and Conditions in Consumer Contracts for Financial Products or Services

The CFPB proposed a new rule to prohibit certain contractual provisions in agreements for consumer financial products or services. The rule applies to any entity that offers or provides consumer financial products or services. The provisions the rule seeks to prohibit are any of the following:

- Clauses that waive substantive consumer legal rights, like waiving a consumer’s right to sue for damages or participate in a class action lawsuit, or limiting the time period within which a consumer can bring a legal claim.

- Clauses that limit free expression, such as restricting a consumer’s ability to post reviews or share experiences about the product or service, or threatening account closure, fines, or breach if a consumer publicly criticizes the company.

- Clauses that undermine a consumer’s ability to pursue legal remedies, or limiting the types of damages a consumer can seek.

The comment period for the proposed rule is slated to end on April 1, 2025.

Request for Information Regarding the Collection, Use, and Monetization of Consumer Payment and Other Personal Financial Data

The CFPB is seeking stakeholder input regarding the collection, use, and monetization of consumer financial data as part of potential forthcoming changes to Regulation P, which implements the Gramm-Leach-Bliley Act. According to the CFPB, the innovation in digital payment services and applications has created a deviation from consumer expectations of how their data is collected and monetized, and many consumers may not understand how their data is collected. The request for information also states that Regulation P has not been amended to keep pace with these industry developments.

Accordingly, the CFPB is seeking evidence to inform how it uses its authorities to address privacy concerns with respect to companies that offer or provide consumer financial products or services, as well as proposed revisions to Regulation P. Comments are due by April 11, 2025.

Policy Statement on No-Action Letters; Policy Statement on Compliance Assistance Sandbox Approvals

The CFPB issued a revised policy statement for No-Action Letters (NALs), which seeks to empower companies to create innovative consumer financial products and services without fear of enforcement actions against them. According to the policy, as part of the NAL application process, each company must meet certain Conditions to Promote Innovation, Competition, Ethics and Transparency (the Conditions).

Notably, the Conditions state that the CFPB will not issue NALs for products that merely improve upon an existing product or service–NALs are designed for more innovative products and services that bring new offerings to market. The Conditions also state that NALs will not be issued to a single company for any NAL topic; rival firms will be encouraged to submit NAL applications on the same topics to promote competition and mitigate advantages for first-movers in a given market.

In conjunction with the revised policy statement on NALs, the CFPB has announced that it is accepting applications for Compliance Assistance Sandbox Approvals (Approvals) subject to the Conditions. An Approval will state to a recipient that offering or providing the described aspects of a product or service in good faith complies with the federal consumer financial law identified therein, providing the recipient with a safe harbor from liability under the relevant statute. The CFPB plans to provide recipients with a Compliance Assistance Statement of Terms which sets forth the terms under which compliance assistance is provided, including the types and scope of assistance provided to the recipient. Approved recipients will become subject to CFPB supervisory authority, if they aren’t already, as part of the compliance assistance program.

Other Recent Releases

In addition to the above-referenced recent actions, the CFPB recently issued:

- A circular on design, marketing, and administration of credit card rewards programs.

- A final rule on overdraft fees.

- A proposed rule on data brokers.

- A final rule to subject digital payment app providers to supervision.

- Last but not least, the final rule on "open banking" and personal financial data rights, implementing Section 1033 of the Consumer Financial Protection Act (CFPA).

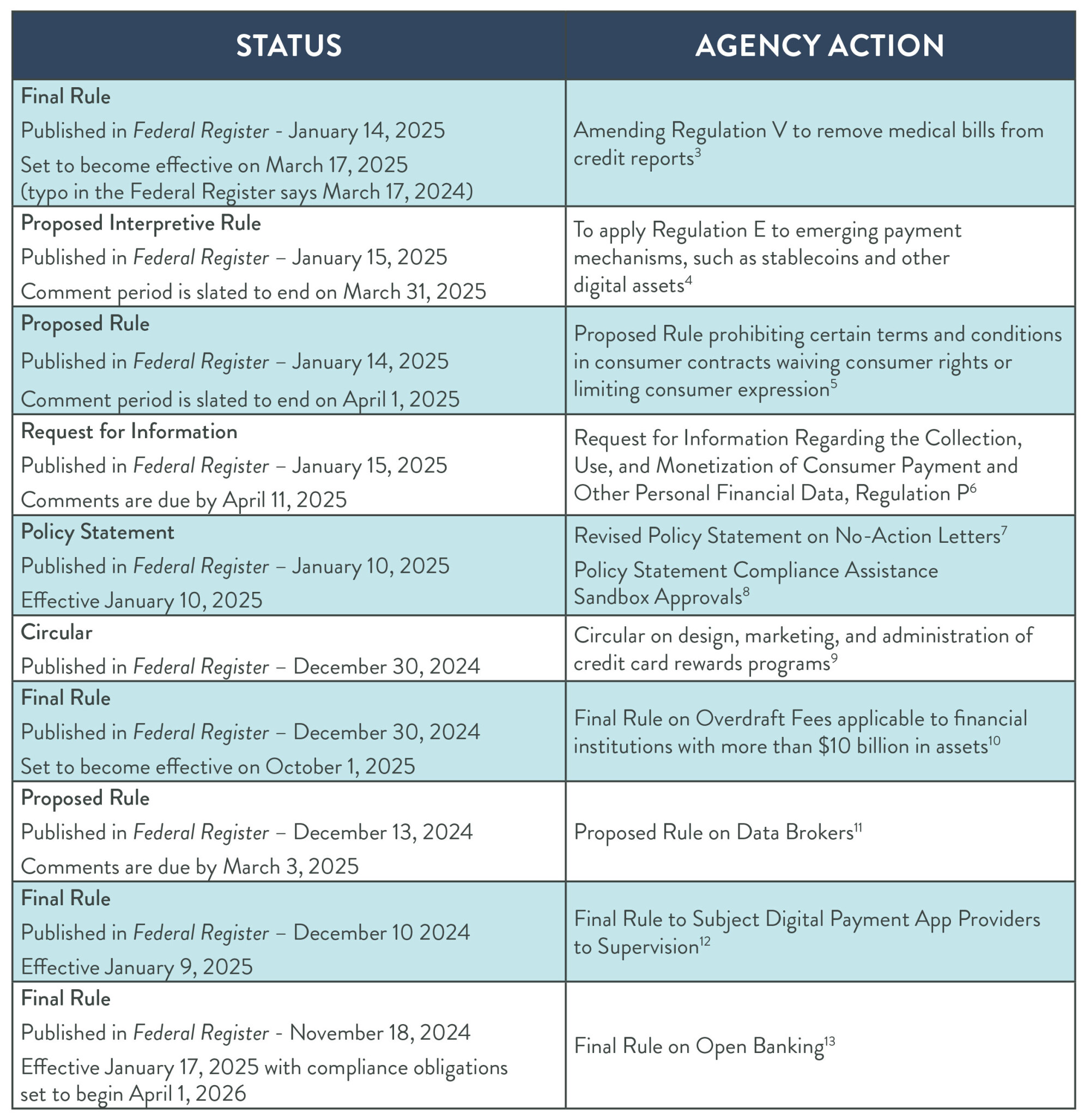

Tracking Recent CFPB Announcement & Initiatives

- https://www.whitehouse.gov/presidential-actions/2025/01/regulatory-freeze-pending-review/

- https://www.reuters.com/world/us/us-treasury-chief-takes-over-consumer-watchdog-freezes-all-activity-2025-02-03/ ; https://www.washingtonpost.com/business/2025/02/03/trump-cfpb-bessent-halt/

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-finalizes-rule-to-remove-medical-bills-from-credit-reports/

- https://www.consumerfinance.gov/rules-policy/notice-opportunities-comment/open-notices/electronic-fund-transfers-through-accounts-established-primarily-for-personal-family-or-household-purposes-using-emerging-payment-mechanisms-electronic-fund-transfer-act-regulation-e/

- https://www.govinfo.gov/content/pkg/FR-2025-01-14/pdf/2025-00633.pdf

- https://www.consumerfinance.gov/rules-policy/notice-opportunities-comment/open-notices/request-for-information-regarding-the-collection-use-and-monetization-of-consumer-payment-and-other-personal-financial-data/

- https://www.govinfo.gov/content/pkg/FR-2025-01-10/pdf/2025-00378.pdf

- https://www.govinfo.gov/content/pkg/FR-2025-01-10/pdf/2025-00377.pdf

- https://www.govinfo.gov/content/pkg/FR-2024-12-30/pdf/2024-30988.pdf

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-closes-overdraft-loophole-to-save-americans-billions-in-fees/

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-proposes-rule-to-stop-data-brokers-from-selling-sensitive-personal-data-to-scammers-stalkers-and-spies/

- https://www.govinfo.gov/content/pkg/FR-2024-12-10/pdf/2024-27836.pdf

- https://www.govinfo.gov/content/pkg/FR-2024-11-18/pdf/2024-25079.pdf